Introduction

In this blog, we will go through the basics of stock market trading/investing.

Why Stock Trading?

Two of the main reasons to be involved in stock trading are:

- Trade/Invest your money to generate income.

- Trade other people’s money to generate income.

So the basic purpose is to generate capital. Everyone has to learn about the stock market at one point or the other in their lives.

What is a Stock?

A Stock is a security that signifies ownership in a corporation. By having stocks in a company you have claim on their assets and earnings. By owning stocks/shares in a company you become a part owner of the firm. A company sells/issues its stocks when it needs to grow by raising a capital. The investor who buys the stock can participate in the growth of the company by owning a part of it (He doesn’t even need to put in work). Traders look for mispricing of stock and if they are able to evaluate when the price is too high or too low, they can take advantage of it and make profit.

Buying a stock: It depends on whether the stock is private/public.

- Private company:

A private company is one with relatively small amount of owners and doesn’t trade on public exchanges.

It is relatively not easy to invest in private companies. We need to be either acquainted with the owner or be a qualified investor with a lot of money. Thus it’s difficult for private companies to get funded.

- Public company:

A public company is a big company that trades on the public exchange. eg:- Apple, Meta, Netflix

Anybody can invest in public companies. You can buy it’s stocks using the brokers from the public exchange where it is traded.

What is a Market?

A market is a location where people go to buy and sell products. Markets are characterised by the products that they specialize in. The Stock market works like an auction market. In an auction market, buyers bid on the best price that they are willing to pay for a product and sellers bid on the price on which they are willing to sell the product. There are two types of stock markets

- Primary Market: The market that the stock trades in the first time.

- Secondary Market: Every other time that the stock trades after the first time.The stock becomes second hand. ie, somebody else owned it before you.

In order for a company to go public, it needs to go through an IPO (Initial Public Offering)

IPO (Initial Public Offering)

Selling stocks from your company to the public for the first time ever. The public will pay for the part of the company you sale to them. An underwriting firm will analyse our company and figure out the best price at which our stock can be sold at the beginning. They help us get the required amount of money by selling the decided amount of stocks. The first selling of these stocks/shares will happen in the primary market. It is very hard to get shares from the primary market (ie, through IPO). When we talk about the buying and selling of stocks/securities we will talk about the secondary market.

What is a Stock Exchange?

Exhanges refer to the exact location where the trades are being executed. eg: Let’s take the case of grocery stores. The term can be compared to that of a Market. But if we refer to a specific store, like Walmart, these can be compared to an exchange.

In the Stock Market, we have different exchanges that we can goto to buy and sell stocks. eg: NYSE (NewYork Stock Exchange), Nasdaq

Back in the 1700’s or 1800’s, to buy a stock, we had to find a person who wanted to sell our required quantity of a stock at the price which we are willing to buy it. It was a very difficult process. So, there were regular meetups in the townhalls and in city centers where people meet and trade stocks. One of those was in New York where financially savy people met and sold/bought stocks. A group of people who started this saw that it was a hassle dealing with lots of people to meet up like this so, they decided to sign an agreement with one another called the buttonwood agreement. The agreement said that they weren’t going to trade stocks with anyone else but themselves (they were 24 people). If someone wanted to buy/sell stocks from them, they were going to charge a commission (a percentage). This location was called the New York Stock Exhange (It originally consisted of 24 brokers). The three main exchanges in the United States are :

- NYSE - Biggest and most demanding exchange (They look at the company before listing in this exchange)

- Nasdaq - Less demanding and most tech companies are on this exchange

- Amex - It is an exchange that caters to ETF’s (Exchange Traded Funds) Some companies are listed in more than one exchange, But mostly they are only listed in one exchange

What is a Broker?

A broker is somebody who you’re going to have to go through to buy/sell a stock. When you want to buy a stock, you have to go to the broker and let him know what stock you want to buy. He will see if another brokers client wants to sell the stock that you want to buy and see if your prices match so that you can transact with one another. As the brokers became more busy, they hired floor brokers. Earlier everything was done manually where the floor brokers would meet physically but with time, it became automated where we can execute orders using a computer and thus didn’t require floor brokers. However, we still have to go through the broker to request that we want to buy/sell the stock only the match-making process at the exchange is automated. We have to pay a commission to the broker for them to route the order to the exchange and do the necessary paper work.

Orders and Order Types

Here, we will discuss what we have to do when we want to buy/sell a stock. We already know we have to contact a broker for this but what should we tell him. We have to send the broker an order of what you want. The things that need to be specified in an order are:

- Ticker - An abbreviation for the name of the company eg: Microsoft(MSFT)

- Side - Buy/Sell order

- Type - Market order, Limit order. Market order tells a broker that you want to buy/sell the stock immediately no matter the price. Limit order tells a broker you want to buy/sell the stock at a limit price or better. Market order is time sensitive while limit order is price sensitive. In case of a limit order, we need to provide a price to your order.

- Quantity - No. of shares to buy/sell

Order Driving Prices

Most people think that it’s news or events that make prices move, but the actual thing that drives prices is orders that people send.

Shares outstanding refers to the amount of shares that your company has.

Floats: The amount of shares that are currently trading in the market.

- Level 2/Book: Represents every single buyer and seller that’s out on the market. From the book or level 2 we create level 1. In level 2, the orders on the buy side are placed according to a price priority and then time priority. The order with the highest price is placed on top of the buy side and the one with lowest price is placed at the top of the sell side. If two orders have the same price, then the one which came first will be on top. Level 2 updates everytime a new order is placed. The order at the top of level 2 buy part is the best ask and the one at the top of it’s sell part is the best bid. Electronic list of buy and sell orders for a stock. This list is ordered by price and then by time. The order book lists the number of shares on the bid and ask at every price point.

- Level 1: It is the best price/bid/offer available on the market. It is updated everytime the best ask/best bid in the level 2 gets updated. Level 1 is an abbreviation for level 2 and Time and Sales. It contains the best ask/bid from level 2 and the last price from Time and Sales. It will give us a general idea of the market. Displays the bid and ask prices as well as quantities. This also displays the last trade executed.

- Time and Sales: This is where the exchange records everything. The exchange has to report on every execution that happens. On it they have to put the name of the stock that they are trading, the time that the trade happened at, the quantity and the price that it happened at. This comes out at the time of sales. The last price at which the stock was executed at is the LTP and will be shown while checking for the price of the stock. Displays every single execution that happens on the market. The executions are displayed real-time and include information like: time, direction, quantity traded and exchange traded on.

Supply and demand is shown through the order book that you can access at level 2, see all the buyers and all the sellers and the price will fluctuate based solely on the orders that people send. The price movement comes from the order matching with one another on the execution system/the matching system at the stock exchange.

- Bid: The best price you can buy on.

- Ask: The best price you can sell on.

- Spread: Difference between ask and bid. The difference between the price of best person who wants to buy and the person who wants to sell. If a stock has an ask of 52 and a bid of 50 and we want to buy it, we can buy it at 52$ and if we sell it next we will sell it at 50$. Thus loosing 2$ in the process even though the stock hasn’t moved. The 2$ is spread. While trading we have to watch out for the spread of a stock.

- NBBO (National Best Bid and Offer): This represents the highest bid and lowest ask available on the market.

Different Players

Different players in the market trade differently. A mutual fund or somebody who has a lot of shares is not going to trade like somebody who is just sitting at home and trading ie, a retail trader. A mutual fund will sell when there’s a good news since then, a lot of buyers will be there. We have to know the institutional ownership of a stock. We need to know who we are trading against. At the end of the day, day-trade is a zero sum game meaning every dollar that we take into our pocket comes from somebody elses pocket. So, we need to know the person we’re taking money from. Prices are going to move because of the buy orders and sell orders that people/participants are sending so we have to know who those participants are. Because they send orders in a different type of manner. The different players are:

- Proprietary Trading Firms (Have lots of tools, information, access and strategies)

- Investors (They invest for a long term)

- Retail Traders (Traders trading from home without sophisticated tools, information or strategies)

- Portfolio Managers (Mutual fund managers - Take money from lot of investors and trade using it)

- Hedge Funds - Like mutual funds, they have big capital and not anyone can put money in a hedge fund. You have to be someone who’s rich enough as they have a minimun investment amount. They are more sophisticated than mutual funds and outperform them. They are very discrete (We can’t know what they are doing.)

3 ways of making money in Stock Market

- Going Long - Buying a stock and selling it at a higher valuation to make money.

- Going Short - Betting that a stock is gonna go down. We make money when stock drops in value. We can short stocks in a margin account. Here we borrow stocks from a broker, then sell it and after it goes down buy it back, take the difference as profit and give back the stock to the broker.

- Being Flat - Being flat means having no positions. If you’re busy then don’t trade, this is a good position to be in.

Introduction to Technical Analysis

We have two ways to try and predict where stock prices are going to go. These two are:

- Fundamental Analysis (Evaluating the stock fundamentally - how many employees, tax system, environment, revenue, expenses, debt) - Used for long term investing

- Technical Analysis (We only check Price and Volume of shares being traded) - Used for trading (Day trading, swing trading)

Charts & Candlesticks

Chart - Charts are just a graphical representations of past price action. Chart is the prices that a product traded at each point in time. When looking at a chart, we are observing historical prices of a stock. Prices going up indicates that the demand for the stock was higher than it’s supply. If prices are going down, it mean more people wanted to sell that product and less people wanted to buy it. Traders use charts to predict where the stock go in the future based on how it moved in the past.

- Line Charts It connects every price point throughout time with a line. Line charts aren’t sufficient enough to get a full picture of what actually happend. That’s why almost always we use candlestick charts.

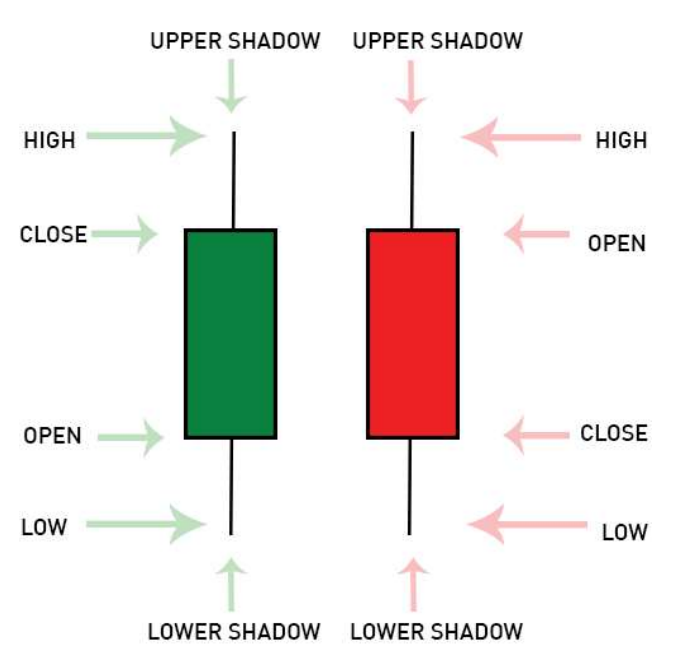

- Candlestock Charts Candlestick is something we draw for each day. A candlestick shows opening price, close price, high price, and low price during a day. In the US and Canadian markets, the market opens at 9:30am, the first trade that happens when the market opens is the opening price. If the first trade happens at 10$, it is the opening price. If the stock price then goes down to 9$, then goes up to 13$ and closes at 12$. Close is the last trade that happend during the day. ie, at 4pm when the market closes. The highest price that the stock traded during the day here 13$ is the high price and the lowest price that the stock traded in during the day 9$ is the low price. By connecting these prices we form a candle. By looking at this candle, it’s top shows the high price, bottom show low price. If a candle is drawn in green, it means it’s price went up today. It opened at 10$ went down to 9$ but closed at 12$. So in effect it went up by 2$ or 20%. Another example is a stock opened at 10$, went up to 12$, then went down to 6$ and closed at 8$. So here the candlestick will be red color and the price went down by 2$ or 20%.

All candles are composed of an upper shadow, lower shadow, open, close, high, and low.

If the open is higher than the close we have a red.

If the close is higher than the open we have a green.

CandleSticks

A graphical representation of the high, low, opening and closing price of a security for a specific period. A green Real Body represents a stock that closed at a higher price than it opened at. A red Real Body represents a stock that closed at a price lower than it opened at. A candlestick can be for any period of time. It can be for a day, a week, for 5 minutes etc. We can have candles for any timeframes. Different candles mean different things. The different candlesticks are:

- Big Candles

As the name suggests, a big candle is a candle of a large size. It indicates that the prices either went down a lot or went up a lot. A bigger candle means a bigger imbalance between how many buyers there were and how many sellers. - Dojis Candles

Doji means indecision. Dojis form when the opening and closing prices are virtually equal. Alone, dojis are neutral patterns. It opens at a price say 10$, then goes up to 14$, then goes down to 8$ they goes up to 10$. It’s opening and closing prices are the same ie, 10$. This indicates indecision of where the stock should go. Neither buyer nor seller wins here. - Long Legger Doji Candles

A Doji with a bigger wick (Wick referes to the high and low on a candle). It means buyers were winning by a bigger amount at one point but then sellers were winning by a bigger amount. But at the end of the day/period, the closing price of the stock is the same as the opening. Which means there is big indecision about where the stock is going. - GraveStone Candles

Here the stock goes all the way up to a certain point meaning there are a lot of buyers (Strong demand) but then it stops and sellers start selling and the price drops all the way to where it opened at. The long upper shadow suggests that the direction of the trend may be nearing a major turning point. It is formed when the opening and closing price of the underlying asset are equal and occur at the low of the day. - DragonFly Candles

Here the stock opens at a price, drops then comes back to the opening price and closes there. The long lower shadow suggests that the direction of the trend may be nearing a major turning point. It is formed when the opening and closing price of the underlying asset are equal and occur at the high of the day. - Morning Doji Star

Morning Doji Star Consists of a large red body candlestick followed by a Doji that occurred below the preceding candlestick. On the following day, a third green body candlestick is formed that closed well into the red body candlestick which appeared before the Doji. It is considered as a major reversal signal. Indicates a bullish trend. Stock goes down with red candlestick until it reaches a doji indicating an indecision, then next candle is a green one. This forms a reverse signal indicating that it may go up subsequently. Dojis make sense when put within a pattern. We can us the morning doji star pattern to time the buying of a stock. If it forms the morning star pattern, we know it will go up eventually so we can time it here and buy it. - Evening Doji Star

Evening Doji Star Consists of three candlesticks. First is a large green body candlestick followed by a Doji that gap above the green body. The third candlestick is a red body that closes well into the green body. When it appears at the top it is considered as a reversal signal. It signals a bearish trend. - Shooting Star

Here the stock opens at a certain price, goes all the way up and come down and closes just above where it opened. It will have a small green candle. A black or a white candlestick that has a small body, a long upper shadow and a little or no lower tail. Considered a bearish pattern in an uptrend. - Hammer

Here the stock opens at a certian price, goes all the way down and come up and closes just below where it opened. It will have a small red candle. A black or a white candlestick that consists of a small body near the high with a little or no upper shadow and a long lower tail. Considered a bullish pattern during a downtrend. - Bearish Harami

Here we have a very big green candle and then a smaller red candle that opens within the body(within open and close of the candle) of the green candle. In a chart this indicates that the up movement has exhaused. So, we expect a trend reveral ie, the stock to go down. As the name bearish suggests we have a view that the stock will go down. - Bullish Harami

Here we have a very big red candle and then a smaller green candle that opens within the body(within open and close of the candle) of the red candle. In a chart this indicates that the down movement has exhaused (Sellers have exhausted). So, the stock will go up. As the name bullish suggests we have a view that the stock will go up. Bearish and Bullish Harami helps to time the buy/sell of stocks. - Engulfing Bullish

Here a green candle engulfs a smaller red candle indicating the stock will go up. Consists of a small red body that is contained within the followed large green candlestick. When it appears at bottom it is interpreted as a major reversal signal. - Engulfing Bearish

Here a red candle engulfs a smaller green candle indicating the stock will go down. Consists of a small green body that is contained within the followed large red candlestick. When it appears at top it is considered as a major reversal signal.

Trends

Trends is something that is at the core of technical analysis. Prices tend to move in trends and history tends to repeat itself. A trend is just a direction. Stocks can have trends they can go in one direction. They can have an uptrend meaning it is going up. They can have a downtrend meaning it is going down. Stocks only move in three directions - up, down, and side.

- UpTrends

Stocks don’t move in a straight line, they will fluctuate. In an uptrend, every time we have a high, the next high is higher and every time we have a low, the next low is higher. - DownTrends

In a downtrend, every time they have a high, the next high is lower and every time we have a low, the next low is lower. - SideTrends

If the lows and highs are at the same price, the stock is moving sideways.

If a stock a going up in an uptrend, then it will probably be going in that direction. That’s why it’s said go with the trend/ the trend is your friend. Don’t go against the trend.

TrendLines: A line we draw along the lows of a trend. It will give us the general direction of the trend weather it’s up/down. Trends don’t last forever. If the price of a stock breaks the trendline that we drew, then it’s over it won’t continue in the same direction as the trend.

Channels: When drawing trendlines we draw 2 lines one on the high and one on the low of the trend and we call it a channel. The stock will move in a channel within a lower and upper trendline. We can have up channels where the stock is going up and down channels where the stock is going down. We also have side channels. Within a channel, we can buy when it’s at a lower and sell when it’s in the upper. Drawing channels on stock charts will help us to time the buy and sell of a stock.

Support and Resistance

Channels and trendlines serve as support and resistance. Support is something that supports a price, supporting that it doesn’t fall below a certain price. Resistance is something that the price can’t go through (It can’t go higher than this). The lower trendline is a support line. The upper trendline in the resistance line. When we are trading a stock in the support and resistance, we should buy on the support and sell on the resistance. Trends can be observed in any timeframe, daily, 5 minutes etc. Trends can channels will help us to decide on the entry and exit points. It has been proven that trends persist. The real reason why is because almost everyone sees the trend line and wants to buy on the support line so, place buy orders on the support line which inturn create high demand for the stock at that point and ensures it doesn’t go below it. Support and resistance are caused by people buying and selling on the high and low trend lines.

Support and resistance values will often be round numbers since people will buy at values like 100,50,75,25 etc. We should buy above support and sell below resistance points. Since support and resistance will be in round number values, buy and sell in non-round values like 75.04, 99.9 etc because there will be many people placing order at 100, 75 etc and it will be very difficult to buy at that value.

A stock going in an uptrend and suddenly breaks it’s support and goes down. When it breaks support, the support/resistance role is reversed. The previous support line now becomes the resistance line. If it was in a downtrend, and it breaks the resistance, it will become the support.

Support and resistance are stronger in intra-day trading because it’s the same people who are buying and selling.

Stock Screener for traders: Finviz

Prices of stock are only affected by what other people are going to be doing.

- Trend Lengths

There are trends with different lengths like long-term trend, medium-term trend, and short-term trend. Within a long-term downtrend, there can be multiple short-term uptrends and medium-term uptrends. We should analyse the trend depending on how long we are planning on holding the stock. If we are doing intra-day, then short and medium trends are useful.

Chart Patterns

They give you an indication of either continuation or reversal. Observing chart patterns will help us to identify if the stocks will keep on going in the same direction or will go in the opposite direction. This happens because history tends to repeat itself in technical analysis. Since it’s people who are responsible for up and down of a stock, it is in correlation with their emotions. Emotions of people don’t change over time so, what happened earlier tends to repeat itself. Some of the main chart patterns are:

- Head and Shoulders

It’s one of the most famous chart pattern. It is called so because in this pattern the stock goes up to a high then goes down, then goes up again to a point higher than the previous high. Then it goes down and goes up to a point lower than previous high. There is left shoulder, head, right shoulder. In this case the support is called neckline.

The theory behind head and shoulders is that after the second shoulder, since it wasn’t able to go as high as the previous high, it’s going to break the neckline and if it does break the neckline, it gives us an indication to sell the stock. We would expect the stock to break. - Double Top

It is a chart that topped at 2 different locations. It went to a high then traded somewhere else (went down), then came back to that high but wasn’t able to break it and came back down. Now we have 2 tops. What this chart tells us is that the 2 tops price level is a resistance for the stock ie, stock fails to break that point. The stock is unable to break this top because there is probably a seller trying to sell the stock by a limit at that top to make profit. Double tops are useful in various time frames. - Multiple Top

It is very similar to double top but has multiple tops. The difference is that it tested that top another time and failed to break it making it more stronger. - Double Bottom

It is the opposite of double top. Here the stock goes down to a certain point then goes back up and then goes down but not beyond the previous down point. It has a support line and most likely won’t break it. A lot of people will be placing their buy orders at that point. - Multiple Bottom

Same thing as Multiple top but it has multiple points in the bottom. It will have a strong support line. - Triangles

- Ascending Triangle : Here the support line will be going up. Buyers become more aggressive and are willing to pay more for the stock thereby making each subsequent down point higher than the previous one making a support line that is point up. The resistance line is straight. It will reach a point where the buyers and sellers reach same price point. Who wins at that point decides where the price will go from there. The buyers have a more chance of winning and the stock prices will go up.

- Descending Triangle: It’s the same thing as the ascending triangle, but here the sellers become more aggressive and start selling at lower price. Here the sellers will push it down and the stock prices will go down. We should take position after the break happens ie, when the sellers and buyers price meet. This decides whether the price will go up or down.

- Regular Triangle (Wedge): Here sellers are selling at lower and lower prices and buyers are buying at higher and higher prices. Both the sellers and buyers are being more and more impatient. This forms a wedge or a triangle like shape. In the end either the seller or buyer will win and it will break out in one direction. Once it breaks, it will continue to go in that direction. Once it breaks and goes up, the previous resistance becomes support. If the price goes further into the wedge, it will really explode when it breaks out. In case of wedges we can have wedge up, wedge down.

- Cup and Handle

It is a very rare chart pattern. Here the price starts dropping, but then it starts dropping slower and slower and then it stops and then it starts picking up and it picks up very faster and after that it reconsiliates and breaks up and goes up as much as the distance it went down. Here the prices dropping and rising forms a cup and while reconsiliating forms a handle thus, called so. - Rounding Bottom

It looks somewhat similar to cup and handle, but doesn’t likely have a reconsiliation. Once it picks up, it likely goes up higher.Only the patterns used by most people will affect the behaviour of a stock price.

Volume

Technical analysis mainly deals with price and volume. If a 100 shares traded hands then the volume of the stock is 100. Volume describes the number of shares that were sold and bought. On each day we can see how many shares of a particular stock were traded. Volume is important as we need enough quantity to be traded at a price to confirm the price it’s trading at is valid/correct. A price movement without enough volume is meaningless. Volume preceeds price. When something happens and the stock is going to move, a lot of volume will come in before the price begins to move. Before prices start to go up, a lot of people will be buying the shares meaning an increase in volume, only then the prices will start moving up as there is an increase in demand. If the prices are going up but there is very less volume, then the probability of continuation is very low.

Big moves in stock price are supported with high volume. It could either be prices going down or up. If there is a movement with less volume it could mean that there weren’t many sellers to sell at a meaningful price and thus the buyer had to purchase at a higher price, thus the price wouldn’t continue to go up.

- Average Volume

Average amount of shares that a company buys/sells. We usually look at the 3 month average of a stock. We look at the average since in some days it can trade at a low volume and in some days high volume. The average daily quantity of shares that have been traded for the past X period. Usualy this is calculated on the past 3 months. - Relative Volume

Relative volume compares the current volume to the average volume that the stock should have at the same time of day. If the relative volume is over 1 this means the stock is experiencing more then it’s usual volume. If for example the relative volume is 4, this means the stock is experiencing 4 times it’s usual volume. To understand if the volume of a stock is high/low, we observe the relative volume of that particular stock on that day with respect to how much volume it usually trades. We cannot compare volume of one stock to that of another stock.

Indicators: Bollinger Bands

Technical indicator: Mathematical computation based on historical price and volume which aims to help forcast future price mouvement and is mostly used for entry/exit signals.

Bollinger bands are one of the multiple indicators that we have access to when we trade stocks. We use bollinger bands when we are running a mean reverting strategy.